Property Tax Rate In Alberta Canada . property tax in dollar terms is calculated by multiplying the assessed property value and the mill rate and dividing by 1,000. Property value assessment (how much. Rates may vary from year to year but typically range between 0.5% to 2.5% 2024 property tax rates are set by property tax bylaw 14m2024. property taxes are one of the most frequently overlooked ongoing expenses associated with homeownership. according to the most recent property tax rates, an albertan homeowner in wetaskiwin—which has the highest property tax rate. For information on how the tax rate is determined or how your tax. property tax information, assessment and appeals, and seniors property tax deferral. 35 rows however, all property taxes in canada are based on two critical factors:

from www.savvynewcanadians.com

Property value assessment (how much. property tax information, assessment and appeals, and seniors property tax deferral. 35 rows however, all property taxes in canada are based on two critical factors: Rates may vary from year to year but typically range between 0.5% to 2.5% according to the most recent property tax rates, an albertan homeowner in wetaskiwin—which has the highest property tax rate. For information on how the tax rate is determined or how your tax. 2024 property tax rates are set by property tax bylaw 14m2024. property tax in dollar terms is calculated by multiplying the assessed property value and the mill rate and dividing by 1,000. property taxes are one of the most frequently overlooked ongoing expenses associated with homeownership.

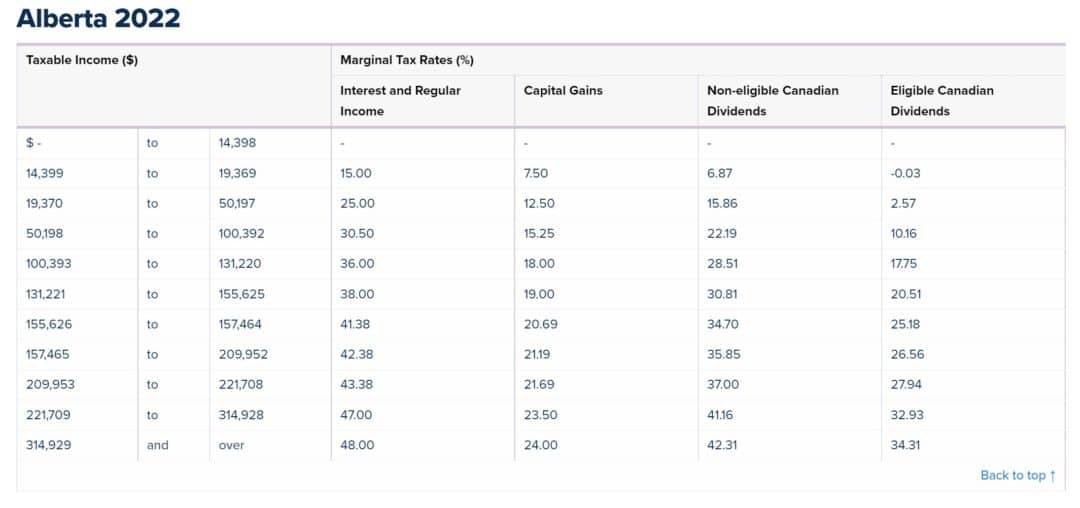

Alberta Tax Rates and Tax Brackets in 2024

Property Tax Rate In Alberta Canada Rates may vary from year to year but typically range between 0.5% to 2.5% property tax information, assessment and appeals, and seniors property tax deferral. For information on how the tax rate is determined or how your tax. Rates may vary from year to year but typically range between 0.5% to 2.5% 35 rows however, all property taxes in canada are based on two critical factors: 2024 property tax rates are set by property tax bylaw 14m2024. property taxes are one of the most frequently overlooked ongoing expenses associated with homeownership. property tax in dollar terms is calculated by multiplying the assessed property value and the mill rate and dividing by 1,000. Property value assessment (how much. according to the most recent property tax rates, an albertan homeowner in wetaskiwin—which has the highest property tax rate.

From taxfoundation.org

How High Are Property Taxes in Your State? Tax Foundation Property Tax Rate In Alberta Canada property taxes are one of the most frequently overlooked ongoing expenses associated with homeownership. 2024 property tax rates are set by property tax bylaw 14m2024. 35 rows however, all property taxes in canada are based on two critical factors: property tax information, assessment and appeals, and seniors property tax deferral. For information on how the tax. Property Tax Rate In Alberta Canada.

From realestatemagazine.ca

Comparing property tax rates in Alberta Property Tax Rate In Alberta Canada Rates may vary from year to year but typically range between 0.5% to 2.5% Property value assessment (how much. according to the most recent property tax rates, an albertan homeowner in wetaskiwin—which has the highest property tax rate. 35 rows however, all property taxes in canada are based on two critical factors: 2024 property tax rates are. Property Tax Rate In Alberta Canada.

From www.homesforsale.ca

Property Tax in Alberta 8 Cities With the Lowest Rates [2024] Property Tax Rate In Alberta Canada according to the most recent property tax rates, an albertan homeowner in wetaskiwin—which has the highest property tax rate. property tax in dollar terms is calculated by multiplying the assessed property value and the mill rate and dividing by 1,000. 2024 property tax rates are set by property tax bylaw 14m2024. Rates may vary from year to. Property Tax Rate In Alberta Canada.

From doroteawlin.pages.dev

Alberta Tax Brackets 2024 Toni Agretha Property Tax Rate In Alberta Canada For information on how the tax rate is determined or how your tax. Rates may vary from year to year but typically range between 0.5% to 2.5% Property value assessment (how much. 35 rows however, all property taxes in canada are based on two critical factors: property tax in dollar terms is calculated by multiplying the assessed property. Property Tax Rate In Alberta Canada.

From www.edmonton.ca

Property Taxes City of Edmonton Property Tax Rate In Alberta Canada 35 rows however, all property taxes in canada are based on two critical factors: property tax in dollar terms is calculated by multiplying the assessed property value and the mill rate and dividing by 1,000. property tax information, assessment and appeals, and seniors property tax deferral. Rates may vary from year to year but typically range between. Property Tax Rate In Alberta Canada.

From yokoqsapphire.pages.dev

Marginal Tax Rates 2024 Alberta Drucy Zitella Property Tax Rate In Alberta Canada Property value assessment (how much. according to the most recent property tax rates, an albertan homeowner in wetaskiwin—which has the highest property tax rate. Rates may vary from year to year but typically range between 0.5% to 2.5% For information on how the tax rate is determined or how your tax. property tax in dollar terms is calculated. Property Tax Rate In Alberta Canada.

From retirehappy.ca

New tax rates in Alberta Property Tax Rate In Alberta Canada property tax information, assessment and appeals, and seniors property tax deferral. For information on how the tax rate is determined or how your tax. 35 rows however, all property taxes in canada are based on two critical factors: according to the most recent property tax rates, an albertan homeowner in wetaskiwin—which has the highest property tax rate.. Property Tax Rate In Alberta Canada.

From canadainfo.net

The Best and Worst Cities in Canada for Property Taxes Canada Info Property Tax Rate In Alberta Canada property tax information, assessment and appeals, and seniors property tax deferral. 2024 property tax rates are set by property tax bylaw 14m2024. property tax in dollar terms is calculated by multiplying the assessed property value and the mill rate and dividing by 1,000. Rates may vary from year to year but typically range between 0.5% to 2.5%. Property Tax Rate In Alberta Canada.

From www.fraserinstitute.org

Property Tax Rate In Alberta Canada For information on how the tax rate is determined or how your tax. Rates may vary from year to year but typically range between 0.5% to 2.5% property tax in dollar terms is calculated by multiplying the assessed property value and the mill rate and dividing by 1,000. 2024 property tax rates are set by property tax bylaw. Property Tax Rate In Alberta Canada.

From www.zoocasa.com

Alberta Cities with The Highest and Lowest Property Tax Zoocasa Property Tax Rate In Alberta Canada Rates may vary from year to year but typically range between 0.5% to 2.5% For information on how the tax rate is determined or how your tax. 2024 property tax rates are set by property tax bylaw 14m2024. property taxes are one of the most frequently overlooked ongoing expenses associated with homeownership. Property value assessment (how much. . Property Tax Rate In Alberta Canada.

From fcpp.org

2019ProvincialTaxRates Frontier Centre For Public Policy Property Tax Rate In Alberta Canada 35 rows however, all property taxes in canada are based on two critical factors: 2024 property tax rates are set by property tax bylaw 14m2024. property tax in dollar terms is calculated by multiplying the assessed property value and the mill rate and dividing by 1,000. Rates may vary from year to year but typically range between. Property Tax Rate In Alberta Canada.

From workingholidayincanada.com

The basics of tax in Canada » Property Tax Rate In Alberta Canada Rates may vary from year to year but typically range between 0.5% to 2.5% For information on how the tax rate is determined or how your tax. Property value assessment (how much. property tax in dollar terms is calculated by multiplying the assessed property value and the mill rate and dividing by 1,000. property taxes are one of. Property Tax Rate In Alberta Canada.

From www.zoocasa.com

The Highs and Lows of Alberta's Property Tax Rates in 2022 Affordable Property Tax Rate In Alberta Canada 2024 property tax rates are set by property tax bylaw 14m2024. property taxes are one of the most frequently overlooked ongoing expenses associated with homeownership. 35 rows however, all property taxes in canada are based on two critical factors: Property value assessment (how much. For information on how the tax rate is determined or how your tax.. Property Tax Rate In Alberta Canada.

From retirehappy.ca

New tax rates in Alberta Property Tax Rate In Alberta Canada 2024 property tax rates are set by property tax bylaw 14m2024. property tax in dollar terms is calculated by multiplying the assessed property value and the mill rate and dividing by 1,000. according to the most recent property tax rates, an albertan homeowner in wetaskiwin—which has the highest property tax rate. property taxes are one of. Property Tax Rate In Alberta Canada.

From yokoqsapphire.pages.dev

Marginal Tax Rates 2024 Alberta Drucy Zitella Property Tax Rate In Alberta Canada property tax information, assessment and appeals, and seniors property tax deferral. Property value assessment (how much. 2024 property tax rates are set by property tax bylaw 14m2024. property taxes are one of the most frequently overlooked ongoing expenses associated with homeownership. property tax in dollar terms is calculated by multiplying the assessed property value and the. Property Tax Rate In Alberta Canada.

From alizadowney.blogspot.com

the tax place ottawa Aliza Downey Property Tax Rate In Alberta Canada property tax information, assessment and appeals, and seniors property tax deferral. 35 rows however, all property taxes in canada are based on two critical factors: property tax in dollar terms is calculated by multiplying the assessed property value and the mill rate and dividing by 1,000. property taxes are one of the most frequently overlooked ongoing. Property Tax Rate In Alberta Canada.

From realestateinvestingtoday.com

How Much Are You Paying in Property Taxes? Real Estate Investing Today Property Tax Rate In Alberta Canada according to the most recent property tax rates, an albertan homeowner in wetaskiwin—which has the highest property tax rate. property tax in dollar terms is calculated by multiplying the assessed property value and the mill rate and dividing by 1,000. For information on how the tax rate is determined or how your tax. 35 rows however, all. Property Tax Rate In Alberta Canada.

From mintabcarroll.pages.dev

Marginal Tax Rate 2024 Alberta Government Adah Linnie Property Tax Rate In Alberta Canada Rates may vary from year to year but typically range between 0.5% to 2.5% property tax information, assessment and appeals, and seniors property tax deferral. property taxes are one of the most frequently overlooked ongoing expenses associated with homeownership. Property value assessment (how much. 2024 property tax rates are set by property tax bylaw 14m2024. For information. Property Tax Rate In Alberta Canada.